Simplify your revenue management

Sep 3, 2024

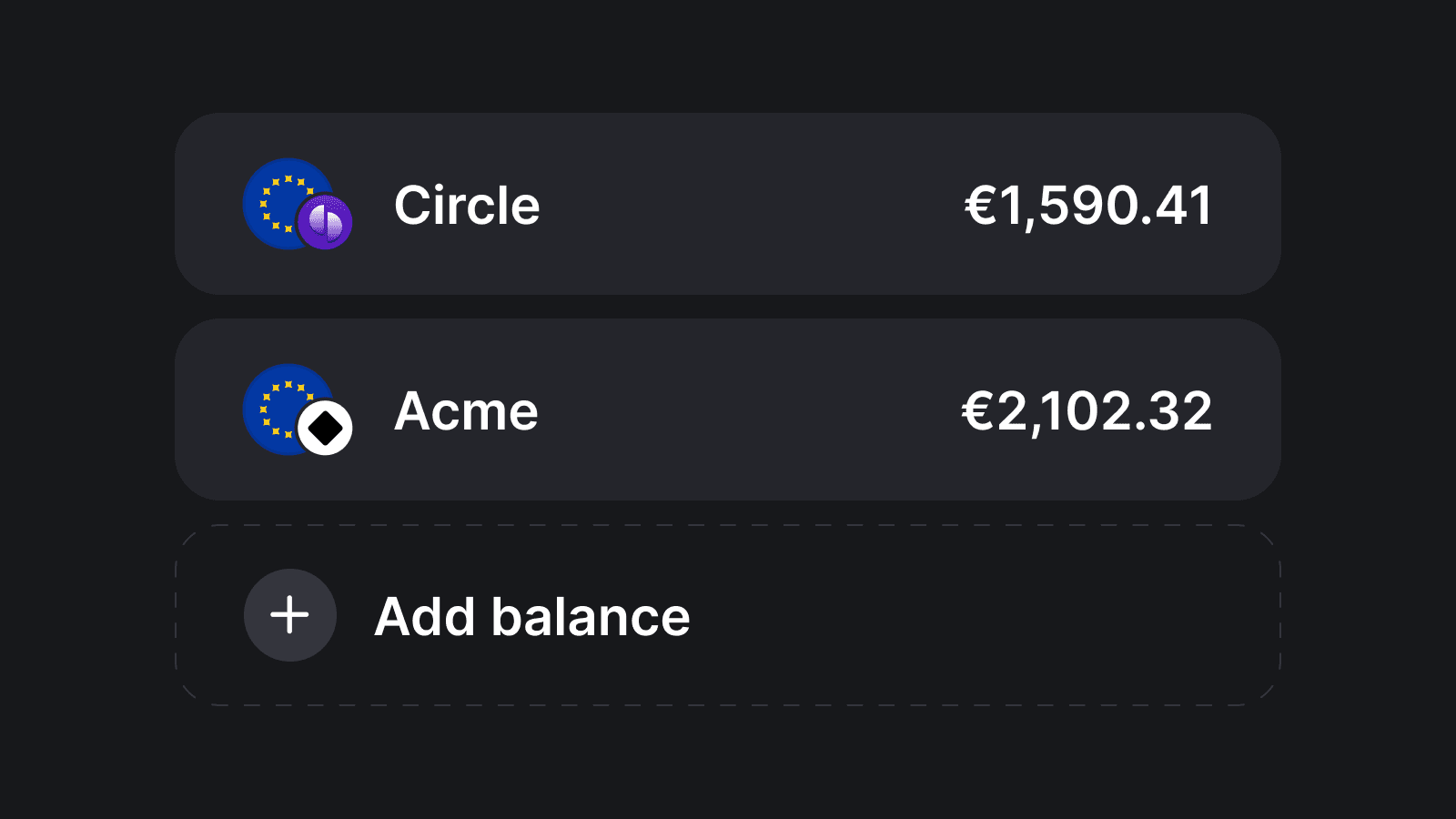

You’re able to create multiple balances under one Mollie account. With this update, you can:

Organise payments: Keep payments and payouts separate for different parts of your business - all under one account

Customise payouts: Set different payout options for each balance, and link each balance to the bank account of your choice

Simplify accounting: Create separate reports for each balance to simplify your accounting

Manage revenue better: Easily split your online and offline earnings, or set up balances for each store location

Visit this Help Centre article to learn more.

iDEAL in3 now available via the Payments API

Aug 29, 2024

Starting today, customers that have integrated the Payments API can accept iDEAL in3 payments.

Simply include a billing address when creating a payment and enable IDEAL in3 on your profile and you are good to go.

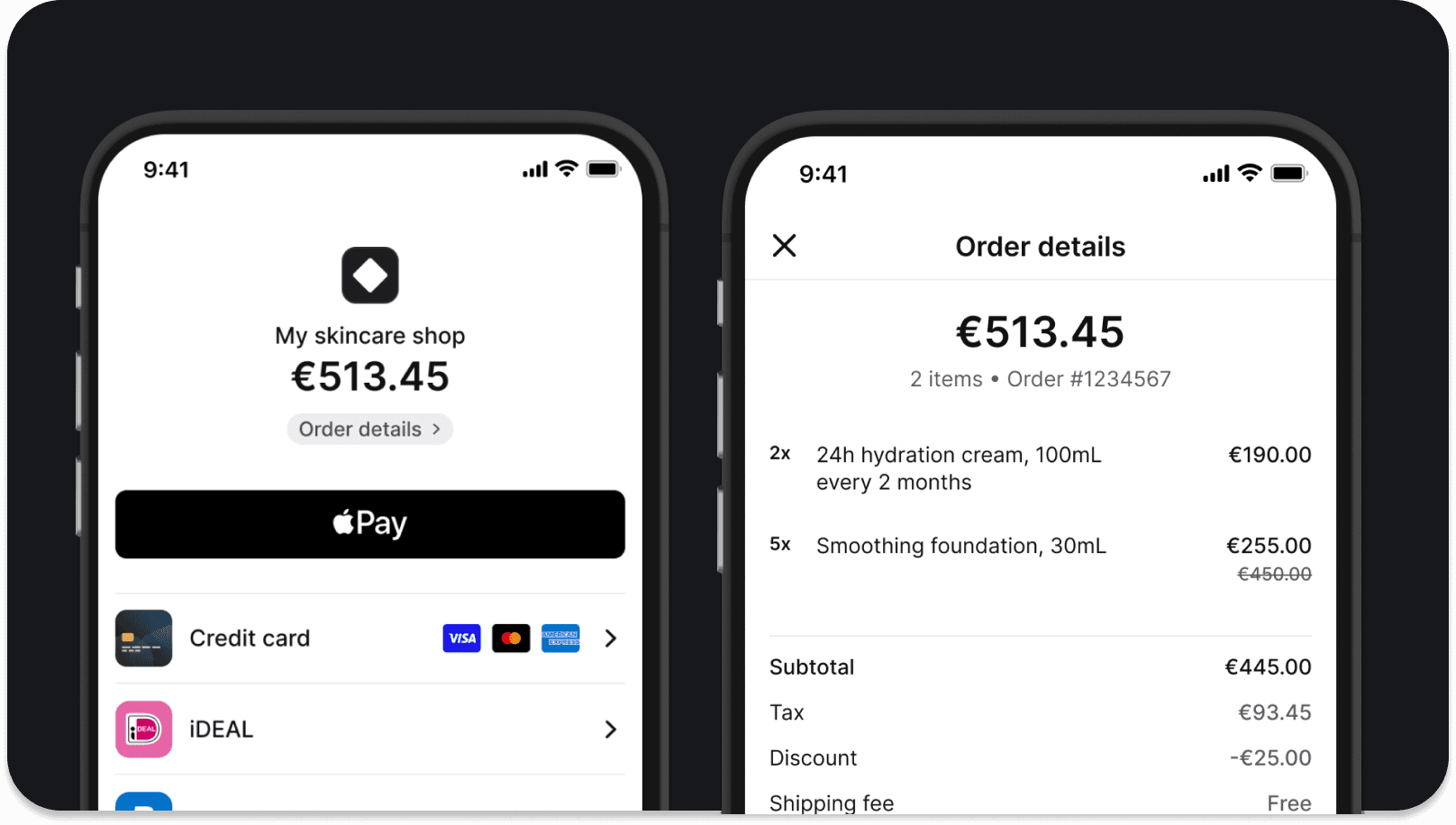

Order overview now available on Mollie Checkout

Aug 22, 2024

Consumers can now view their order details on the Mollie Checkout.

The order details overview will now automatically appear on the Mollie Checkout when you provide the relevant line items details to the Payments API.

This helps improve consumer experience and trust which leads to better conversion rate.

For recurring payments, the new feature also supports details for repeat items. Those details are now mandated by card schemes at checkout.

We just launched Total Revenue for Mollie Capital

Aug 21, 2024

Mollie customers can now access higher funding offers based on every revenue stream, not just their Mollie transactions.

Created in response to customer feedback and powered by Open Banking, Total Revenue allows Capital users to get more money to grow their business.

Discover Total Revenue here.

Mollie App now available as a 2FA method

Aug 20, 2024

We know how important it is to keep your account safe and secure. That’s why we’ve made it even faster to do—you can now use the Mollie App as a two-factor authentication (2FA) method. 📱🔐

Add an extra layer of security to protect your data

Easily approve 2FA requests from your device

Get notified about unexpected changes to your account

New release for webshop plugins

Aug 7, 2024

We're enhancing our range of payment methods to support your growth. Take a peek at our latest additions:

Woocommerce - Introducing Trustly.

Magento 2 - Introducing Alma, Bancomat Pay, Riverty and Trustly.

Shopware 6 - Introducing Alma, ByBank, Bancomat Pay, Blik, Trustly and Payconiq.

Prestashop - Introducing Alma and Bancomat Pay.

Sylius - Introducing Alma.

Opencart - Introducing Twint, Blik, and Bancomat Pay.

Access our documentation to discover how you can seamlessly integrate these new payment methods into your Mollie Dashboard and start accepting them today.

Enhanced notifications on the Mollie Dashboard

Aug 5, 2024

We're excited to announce that as of 29 July, you can now receive trigger-based notifications through three channels:

Notification centre 🆕

Email ✉️

Push notifications from the mollie app 📮

How does this help?

Better understanding: Stay informed about changes affecting your business.

Easy access: Quickly see and act on notifications in your web and app environments.

Enhanced control: Customise what notifications you receive and where.

For more information, visit our help centre.

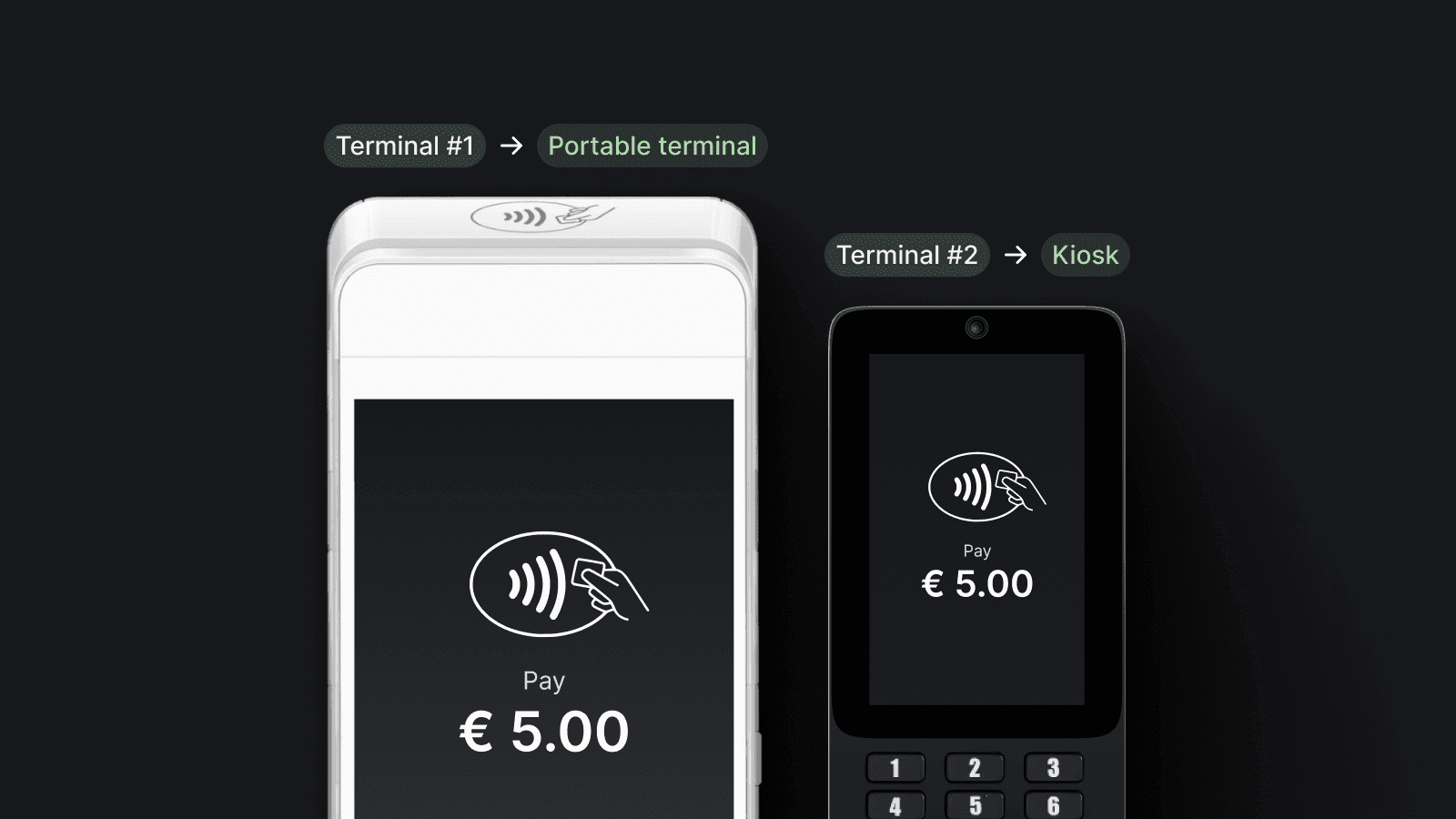

New terminal features available

Aug 5, 2024

We're thrilled to announce some powerful new features to your Mollie Dashboard, designed to give you more control and flexibility over your POS terminals.

What’s new?

Rename your terminal: You can rename your terminals directly from your Dashboard which was previously managed by our support team.

Terminal activation & deactivation: You can now deactivate (pause) your terminals, stopping the monthly fee, and reactivate them whenever needed.

Show terminal settings PIN: Access the PIN protecting each terminal's settings directly in your Dashboard.

Terminal status: Easily view the status of your terminals (ordered, installing, active, deactivated, blocked) within the app.

We're constantly working to enhance your experience and give you more control over your terminals. Stay tuned for more updates.

Mollie’s Onsite Cards App for Shopify is now live!

Jul 30, 2024

Allow your customers to enter their card details directly in the Shopify checkout – no need to redirect buyers to an external payment page. Start offering a one-page checkout experience designed to build trust and win more sales today.

Help your customers pay without redirecting them to an external payment page.

Shoppers stay on the same checkout page, fostering brand continuity.

Process transactions instantly to maintain accurate stock levels.

To start with Onsite Cards, deactivate the existing Cards app and install the new Onsite Cards app. Access our documentation for a step-by-step guide.

The Mollie API V1 is retiring

Jul 29, 2024

Sunsetting API V1

It’s always sad to let things go, but sometimes it’s for the best – and to provide the best experience. So, with that said, we're sadly happy to announce that the Mollie API V1 reached its end of life in July 2023 and will be shut down on 31 December, 2024.

What do you need to do? Upgrade to the latest Mollie API V2. Detailed instructions for migrating from V1 to V2 are available in our technical migration guide.

From September, we'll notify your customers if they are still processing via our API V1. We recommend upgrading as soon as possible.

New Invoicing Features

Jul 29, 2024

Two months ago, we launched Mollie Invoicing. Thanks to your invaluable feedback and ongoing support, we've been able to work tirelessly to enhance your invoicing experience with new features.

Here's what's new:

More invoice templates provide greater flexibility to customise and align your invoices with your brand

Invoice numbering allows you to adjust the sequence to fit your internal processes and maintain consistency in your records

Now, you can apply discounts directly on your invoices to provide clear pricing details to your clients

Add BCC when sending invoices to simplify record-keeping and tracking. This feature ensures you have a backup for every invoice sent

Streamlining payments: Mollie's newest offerings

Jul 29, 2024

We’re halfway through the year, and we’ve already added ten new payment methods and scaled them across new countries.

Alma: The leading buy now, pay later option in France is now available.

Billie: BNPL for B2B customers is now available in France.

Bancomat Pay: Expanded to Italy with leading features.

iDEAL 2.0: Ensuring a smoother checkout experience for your customers.

Trustly: Offers quick, easy bank-to-bank transfers.

Klarna: The new Klarna experience is here.

Riverty: Offer your customers a 30-day invoice with Riverty, available in NL, DE, AT and BE.

Bacs: Bank transfers for one-off and recurring payments in the UK.

Satispay: A popular payment app used across Italy.

Activate them now in your Mollie Dashboard.

Now available for your checkout: Trustly

Jul 10, 2024

We are excited to announce that we launched Trustly, the European bank transfer provider. Trustly enables quick, easy, and secure payments that simplifies the payment experience.

As a leading open banking method, businesses and consumers don’t need to worry about data theft or fraud. Allow your customers to pay instantly from their bank account to boost your conversion and reducing cart abandonments.

Get guaranteed payouts with low processing costs and fast payouts with Trustly and Mollie.

Enable Trustly today through your Mollie Dashboard.

Launching Riverty in four different markets

Jul 10, 2024

We've teamed up with Riverty (formerly known as AfterPay), a leading European BNPL provider.

By adding Riverty to your checkout, you can now offer your customers an additional option to pay afterwards, with a payment period of up to 30 days. Riverty is available in in The Netherlands, Belgium, Austria and Germany.

By offering alternative payment methods like Riverty, you can boost average order values and reduce cart abandonment. Riverty handles all payment reminders and helps consumers manage their finances while protecting your business.

Riverty's solution is seamlessly integrated with Mollie, allowing customers to activate it in their Mollie Dashboard with just a few clicks.

Introducing BancomatPay for Italy

Jun 20, 2024

You can now integrate Italy's 🇮🇹 top payment method, BancomatPay, into your checkout.

By adding BancomatPay, you’ll provide a seamless payment experience for your Italian customers, expand your market reach, and cater to local preferences.

BancomatPay is an extension of the traditional Bancomat network focusing on secure and convenient bank transfer payments.

Switch BancomatPay on today through your Mollie Dashboard. Now available on your eCommerce plug-in via Shopware 6, Magento, WooCommerce, Prestashop, and Shopify.

Billie launches in France

Jun 17, 2024

We're excited to launch Bille, the leading B2B buy now, pay later solution, in France. Billie offers flexible payment terms and automated invoicing.

Your businesses can benefit from improved cash flow and more efficient financial planning with Billie.

Why Billie?

Flexible terms: Improve customer satisfaction with flexible payment options.

Guaranteed payouts: Receive Payments within five business days.

Improved cash flow: Billie mitigates all fraud and credit risk – you receive upfront payments.

Billie is now available in Germany, France, the Netherlands, Austria, and Sweden.

Activate Billie in your Dashboard today.

The iDEAL 2.0 rollout is here.

Jun 17, 2024

Here’s what you need to know:

What’s changing?

Businesses accepting iDEAL payments must transition to iDEAL 2.0 flows. This will help you provide consumers with a quicker and simpler checkout experience, potentially boosting your conversion rates.

What do I need to do?

Depending on your integration with Mollie, specific actions might be required:

Custom integration: Remove bank selection for checkout.

Webshop plugin: Update your ecommerce plugin.

Mollie checkout: No action required. We’ll automatically migrate you to iDEAL 2.0 by 1 July 2024

For more details, see instructions on iDEAL 2.0.

If you’re using an ecommerce plugin, iDEAL 2.0 is now available on: Shopify, WooCommerce, Magento, Shopware 6

Mollie launches invoicing solution

May 28, 2024

If you've ever wanted to quickly create and send invoices from your Mollie dashboard, well, now you can. Introducing Mollie Invoicing - our new hassle-free tool for effortless revenue collection.

You can now do all these things directly in your Mollie Dashboard:

Create, edit, and send branded invoices in minutes – no coding required

Add a Payment Link to every invoice to get paid quicker

Customise due dates and payment terms to fit your business needs

Choose from a variety of invoice templates to match your brand

Go to your Dashboard to start simplifying invoicing today.

Faster onboarding for UK, German, and French customers

May 15, 2024

There’s one really good reason to be in business right now. What is it? The race that fintech firms are running to provide the very best service to businesses (their customers).

We’re in there too, sprinting hard to make our customers’ experiences feel as simple and intuitive as possible. In fact, that’s our mission.

As part of this, we’ve build a functionality that connects directly to your bank account to offer seamless, speedy onboarding to our UK, German, and French customers.

What’s changed?

This functionality lets our customers quickly verify their bank account details during onboarding using the Open Banking technology.

Why are we doing this?

Because our customers told us they wanted faster, easier onboarding – without the burden of digging into files for forgotten numbers and old documents.

In fact, by sharing their bank account holder name and IBAN with us, we can quickly verify their information and get them up and running with payments (and effortless money management) in minutes – not months.

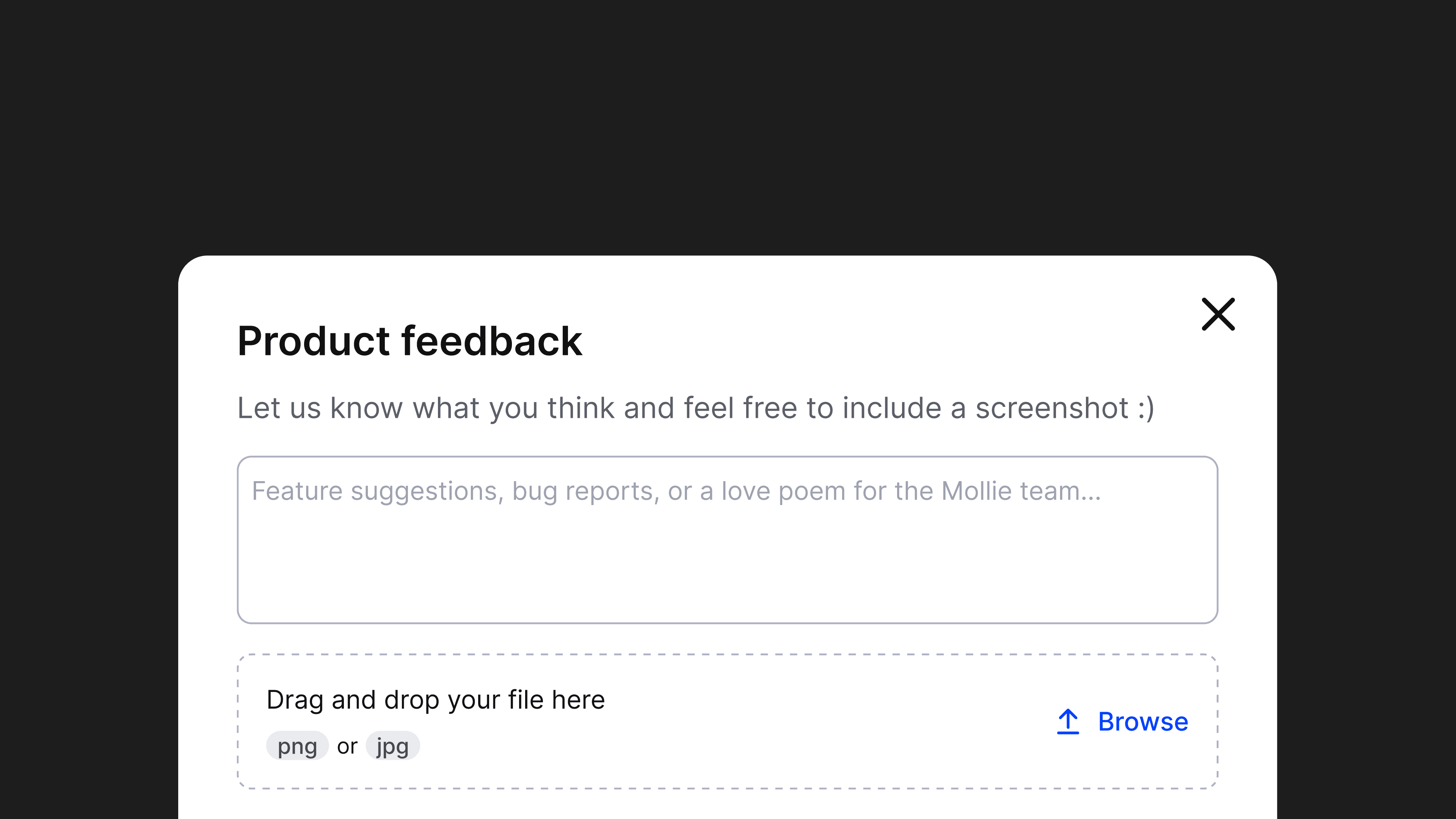

We want to hear from you!

May 6, 2024

We're always looking for ways to improve our product to make your life easier. But we want to hear it from you - let us know what features, improvements or products you'd like to see from Mollie.

Go to Account Menu in the top right and select Give Feedback

Always enough balance for your refunds with reserve

Apr 23, 2024

In the flow of your day-to-day operations, handling customer refunds smoothly and quickly is key.

But when you've got insufficient funds in your Mollie account this can delay the process with the potential for complaints.Introducing Balance Reserve. With Balance Reserve, you can maintain a balance in your mollie account specifically for processing refunds. This allows you to save time, and keep your operations efficient and your customers happy.

To begin, go to your Mollie Dashboard, click on your organisation name in the top left corner.

Go to Organisation settings > Payouts.

Under Balance reserve amount, add the amount you want to keep on your balance.

Step into the world of Edenred with Mollie

Apr 17, 2024

It’s common practice for Belgian employers to offer their staff pre-paid cards loaded with Edenred vouchers.

You can now accepting Edenred with Mollie for online vouchers.

Activate in your Mollie Dashboard today.

New release for webshop plugins

Apr 4, 2024

We're enhancing our range of payment methods to support your growth. Take a peek at our latest additions:

Shopware 6 - Introducing Klarna in the UK.

Magento 2 - Introducing BLIK payment method.

Prestashop - Our plugin makes getting paid and managing money effortless for all businesses – now with TWINT, BLIK and Klarna payment methods.

OXID 6 - Businesses now have access to TWINT and BLIK payment methods.

Activate Klarna, BLIK, and TWINT in your Mollie Dashboard, then add them to your webshop.

in3 rebrand to iDEAL in3

Apr 2, 2024

We're happy to announce that in3 and iDEAL have partnered to bring us iDEAL in3! This rebrand is driven by their commitment to enhancing trust and reliability for consumers in the Netherlands to pay flexibly.

What does this mean for you?

This transition will seamlessly update in your checkout without any action required on your end.

Introducing iDEAL in3:

Enhanced trust: iDEAL's reputable brand instils confidence in payment transactions, fostering trust between merchants and customers.

Streamlined checkout: experience a smoother and more efficient checkout process, enhancing user experience and satisfaction.

Increased conversions: Boost your conversion rates and customer satisfaction with the option to pay in 3 instalments.

If you haven’t activated iDEAL in3, go to your Dashboard to activate it today.

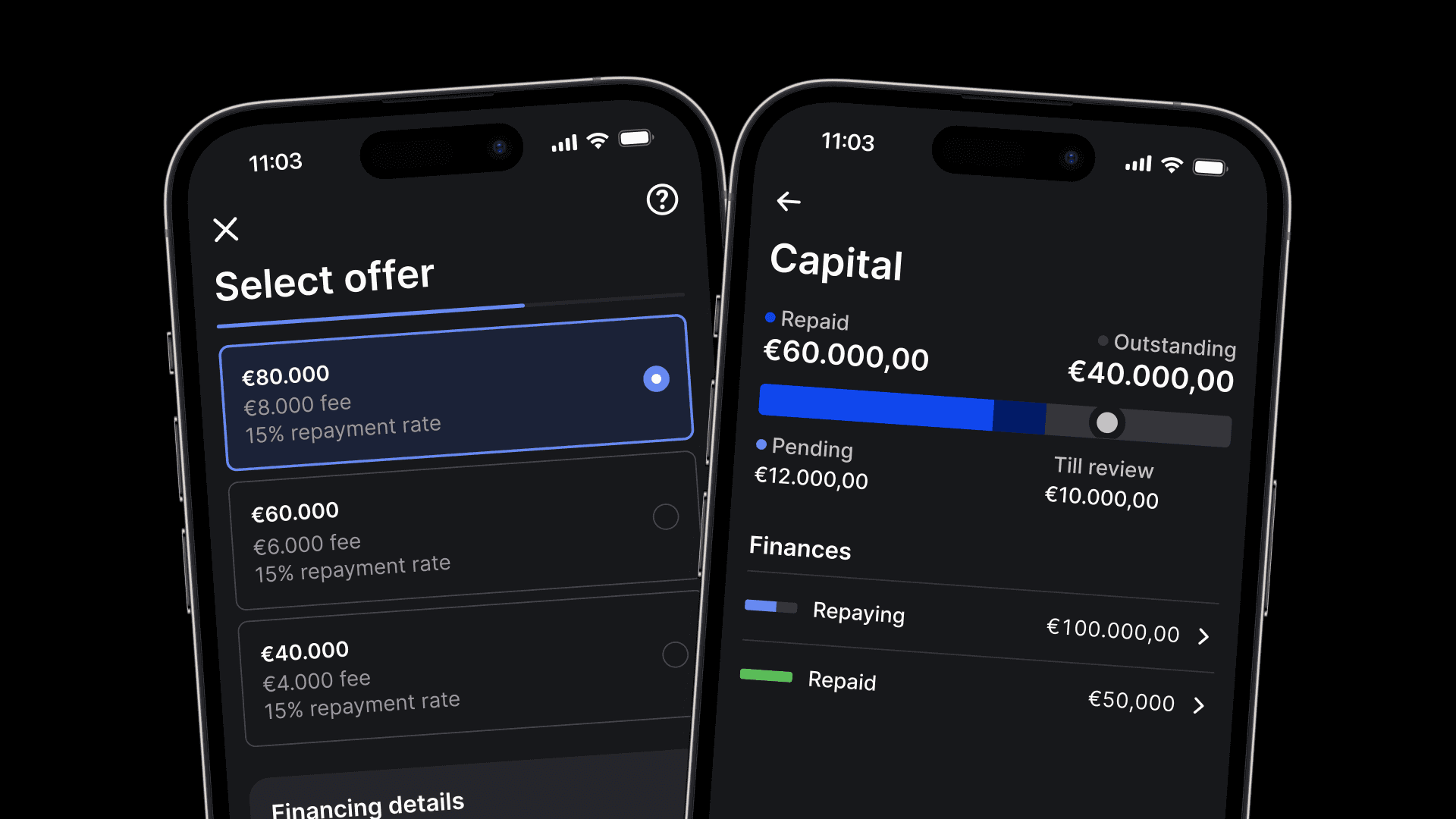

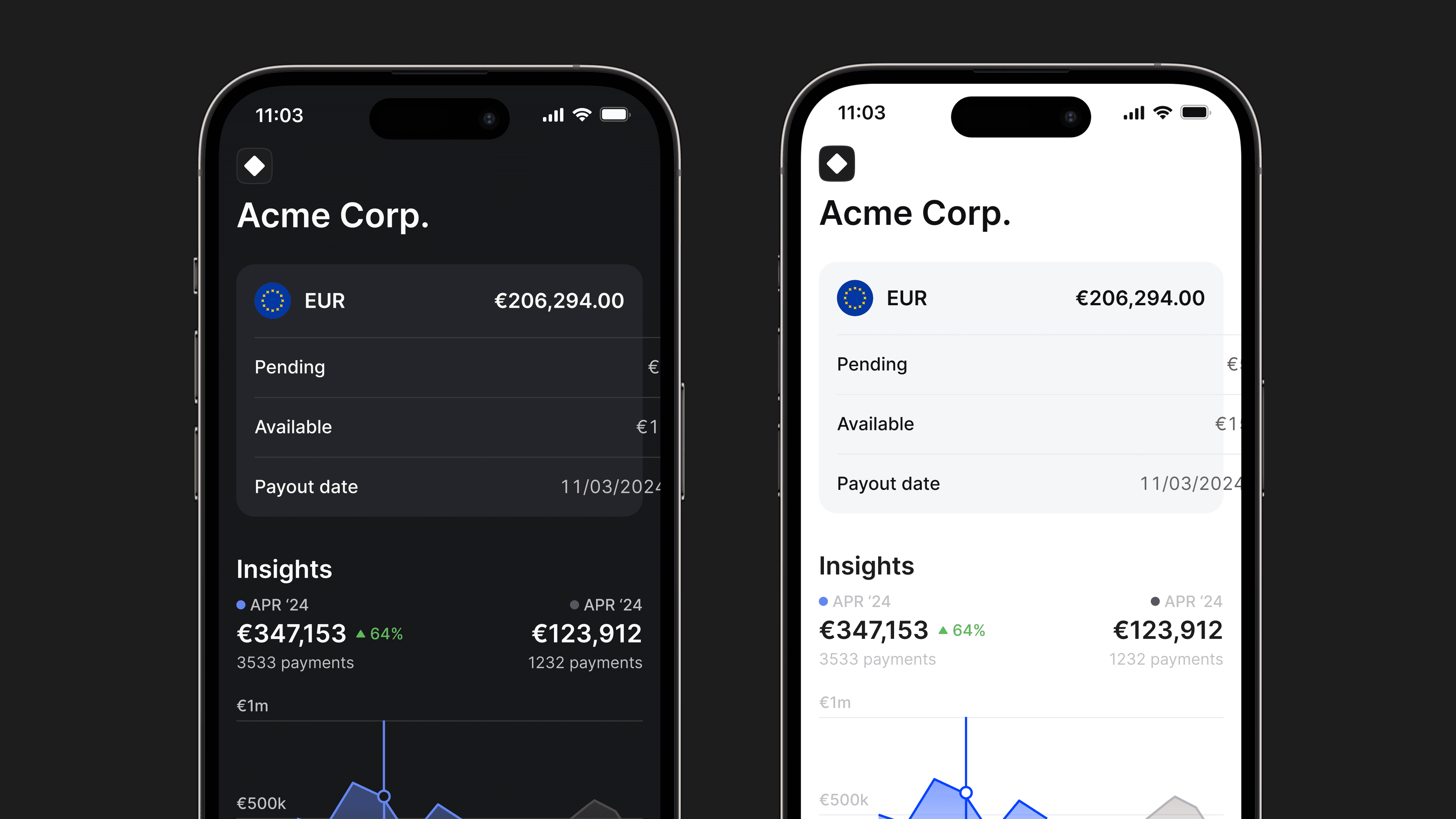

Capital in Mollie App

Mar 27, 2024

You can now apply for Capital directly through the Mollie App. This is a fast and easy way to get funding whenever you need it, wherever you are.

We understand how crucial it is to have quick and dependable access to Capital to support the growth of your business.

Curious? Take a look. Download the app easily and for free via the App Store or Google Play.

The Mollie App is an excellent tool for tracking and managing transactions, including processing refunds. So you can ensure customer satisfaction and keep your balance up-to-date.

New release for webshop plugins

Feb 29, 2024

We’re adding more payment methods to help you expand, introduced our point-of-sale terminal and improved our cards offering for our webshop integrations.

WooCommerce 7.5 - Featuring the introduction of Twint, Blik, and Split Auth Capture for Card

Magento - We've incorporated Twint, a point-of-sale, and enhanced payment links to ensure a seamless Magento experience.

Sylius - Our plugin makes getting paid and managing money effortless for all businesses – now with TWINT and Blik payments.

Shopify - Add Split Auth Capture for Card, bringing efficiency and reducing the risk of chargeback for your card payments.

Here’s how to get started:

Integrate Blik and TWINT in your Mollie Dashboard and then add it to your webshop

Learn more about Split Auth Capture for Card payments

Expand to Poland with Blik

Mar 28, 2024

Introducing Blik, the most popular payment method in Poland.

Blik allows users to seamlessly pay using their mobile phones through their banking app. Blik provides a secure, swift, and convenient payment solution.

Widely embraced as the most popular payment method across Poland, Blik ensures a reliable and efficient payment experience for all users.

Available through your custom integration, Shopify, Woocomerce and Shopware 6. Look out for more integrations coming soon.

Activate the payment method in your Dashboard.

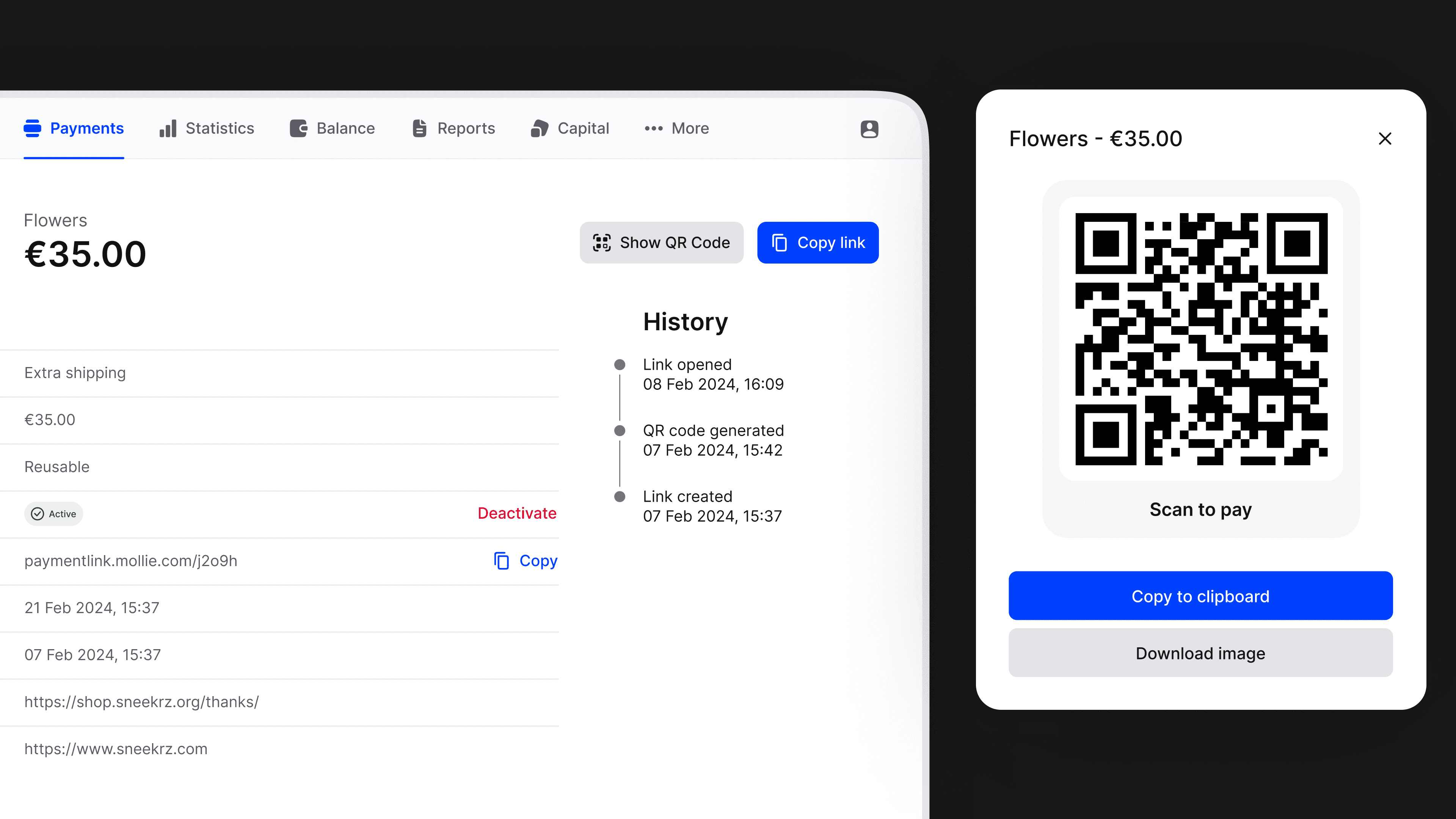

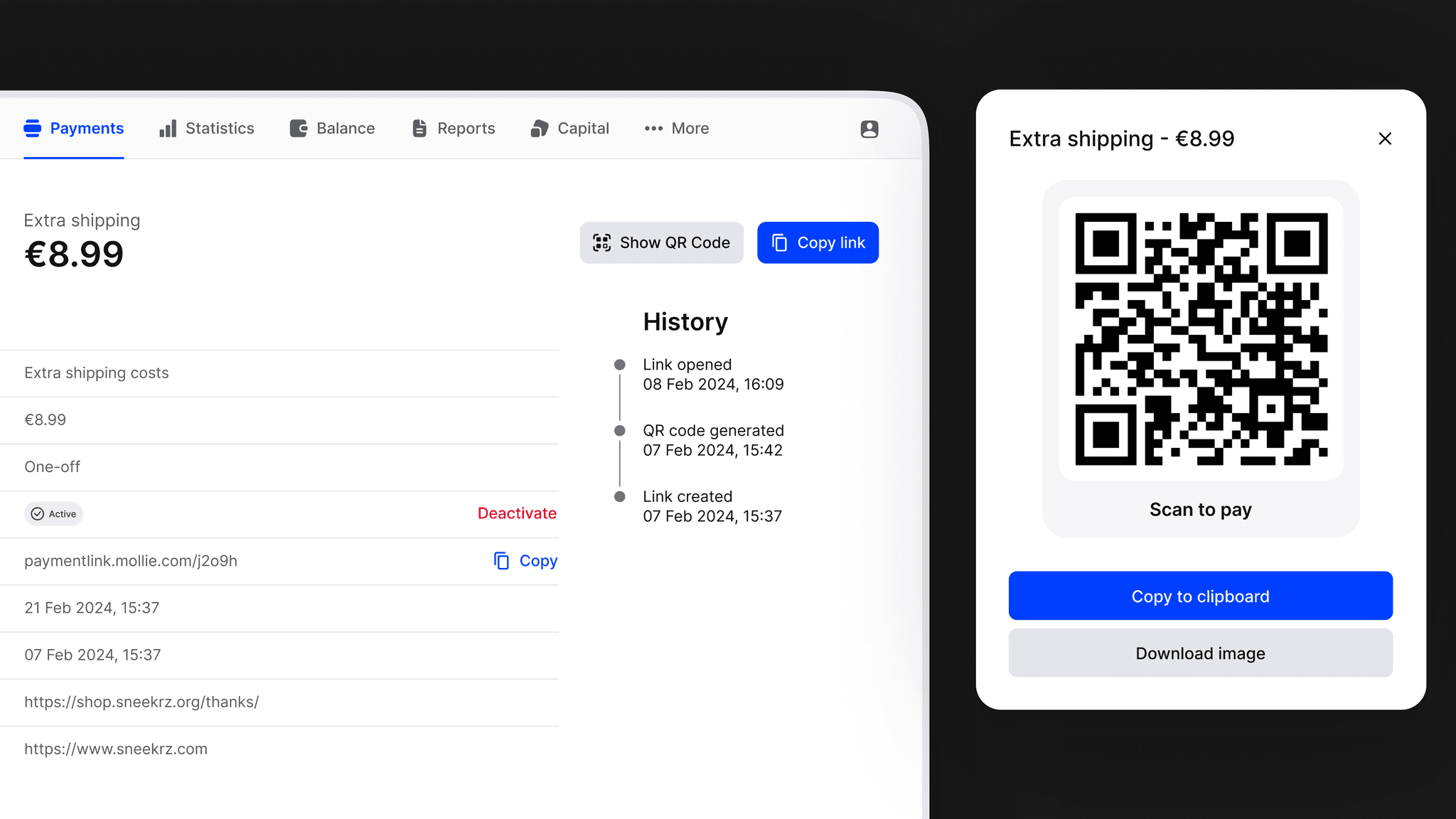

Payment Links

Feb 29, 2024

Plink will soon be discontinued which means you’ll no longer be able to access it at https://useplink.com/ after this date.

Don't worry — we're introducing Payment Links as its replacement! You can send QR codes and links directly from the Mollie Dashboard, Mollie app, and API with Payment Links.

Payment Links with Mollie:

Offer flexibility: Let your customer choose how much to pay for total flexibility.

Fully customisable: Create a one-off reuseable links or share it with multiple customers across different channels.

Stay in control: Get detailed insights about all your payment links in the Dashboard and app.

Check our Help Centre for steps on using Payment Links.

Introducing payout notifications

Feb 20, 2024

Get notified with our new Payout Alerts! Experience the convenience of instant notifications, ensuring you're always alerted when a new payout lands in your bank account.

No more missed updates. Activating this feature is easy – just head to your Mollie App settings and enable Payout Notifications.

Download or visit the Mollie App to activate it now.

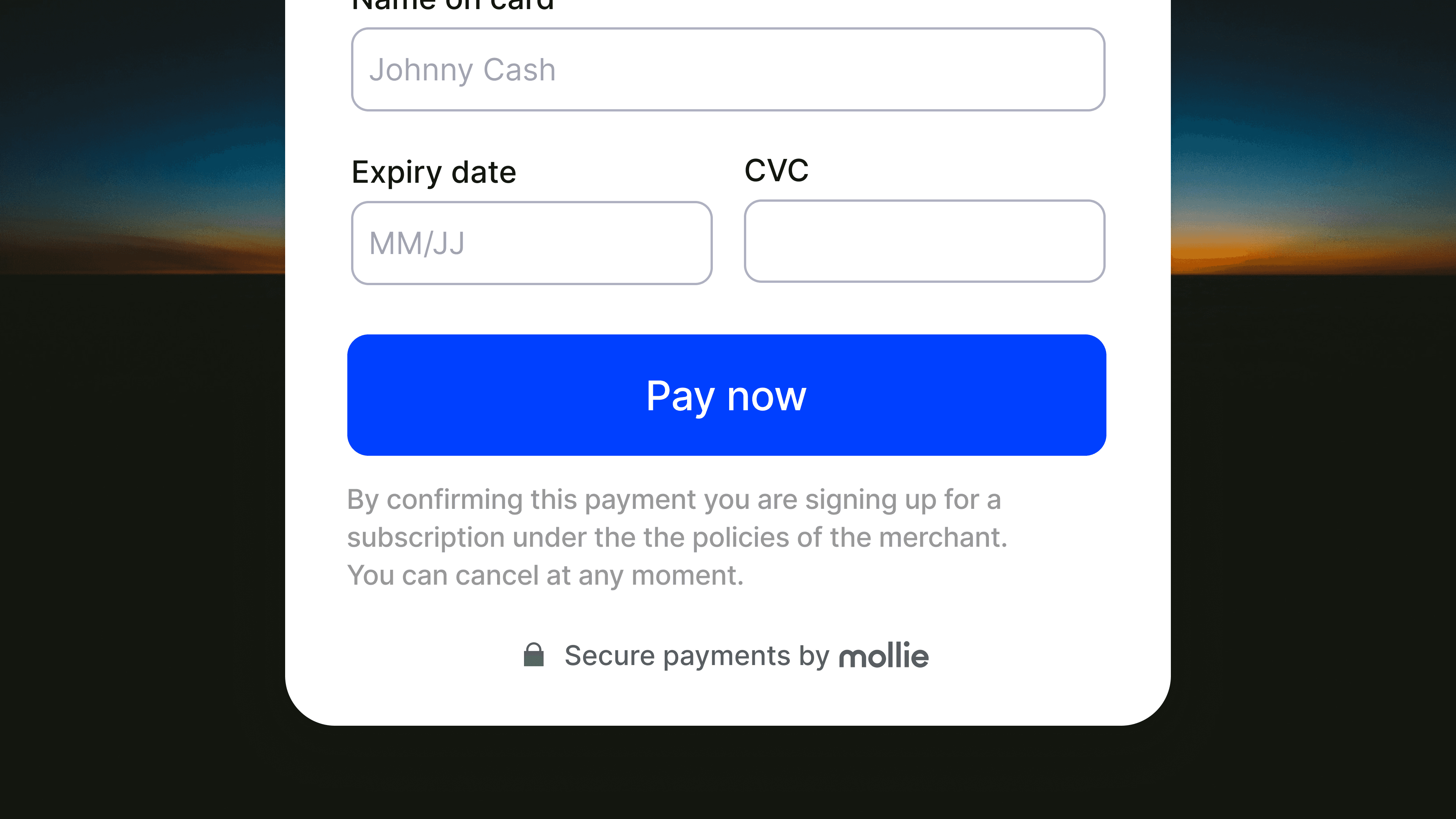

Mollie Checkout - Disclaimer for first of recurring payments

What does this mean?

From now on, if you are using Mollie Checkout to collect card pay details your Shoppers who sign-up to a first of recurring payments (e.g. Subscription signup) will see a new disclaimer under the card form

This disclaimer makes it transparent that they are agreeing to further charges being taken on that card on subsequent dates and their rights to retrieve that authorisation at any time

Why this change?

Customer trust - by being transparent to shopper upfront you can ensure better customer trust and lower failure rates on recurring transactions

Compliance with card directives - Card schemes mandate that it is made transparent to a customer that they are granting the authorisation to further MIT charges when entering their card details

Close your books with Mollie Reporting

Jan 3, 2024

As we get into 2024, and businesses begin to close last year's books, here's what you need to know on finalising your accounts with Mollie:

✅ Streamlined Balances: We've fine-tuned the dashboard layout to make validating your balances a breeze. Easily track and ensure every digit aligns.

⬇ Download your Annual Report: Gain instant insights into your total turnover, payments, and spot any outstanding balances.

Get ready to close the books, your annual report is available now. Visit your Dashboard > under Report > Balance > Download annual report

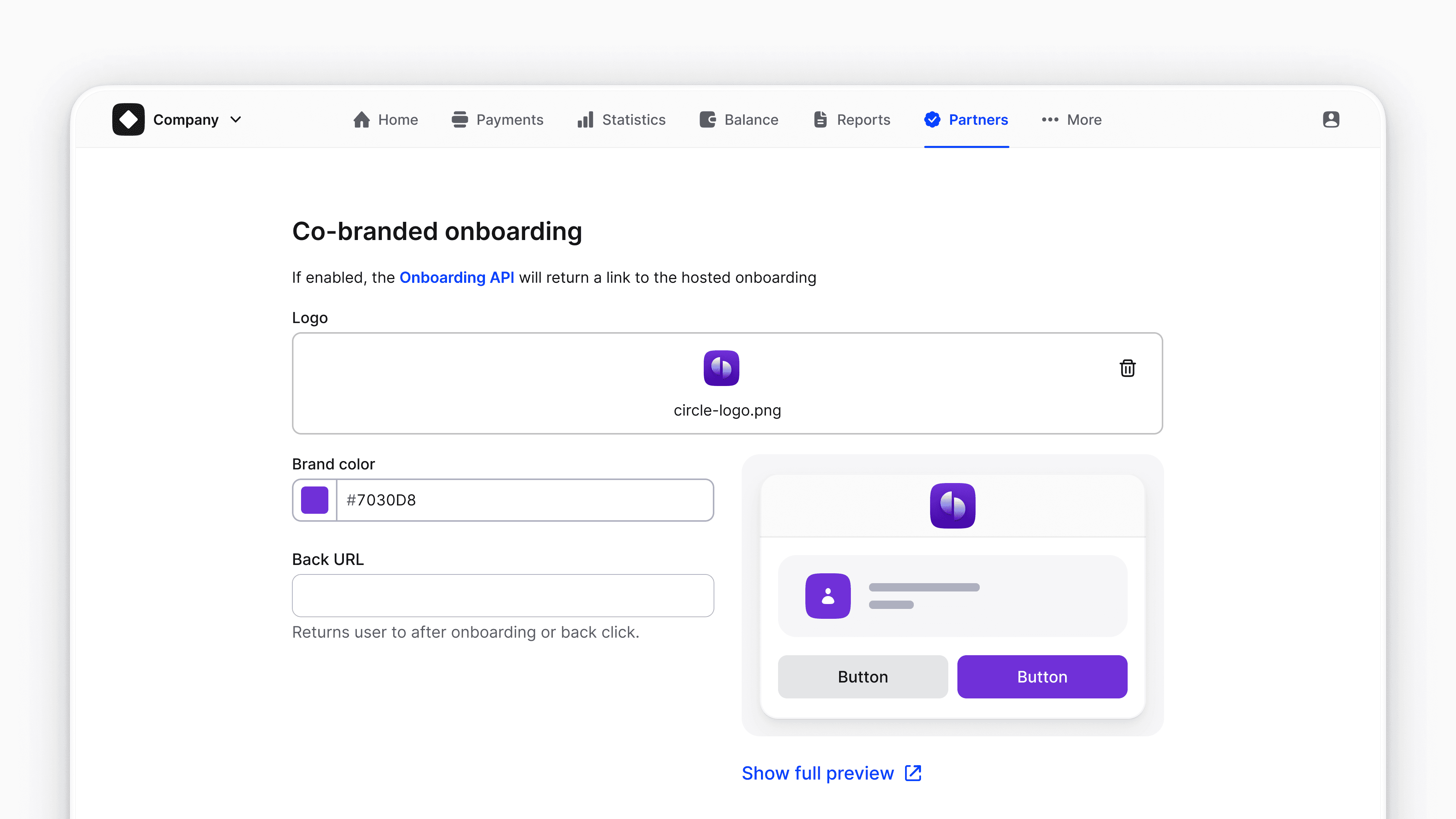

We've made onboarding and managing customer accounts on your platform even easier. Here’s how:

Automate the creation of Mollie accounts - via the Create Link API - and substantially reduce the effort required on your customers part during onboarding

Further reduce the onboarding effort of your customer by sharing all relevant data fields via the Create Link API and the Profiles API.

Access the Client page and monitor the connected customer accounts: their onboarding status, details and enabled payment methods. Also now downloadable to CSV or other formats.

Through Co-branded Onboarding, you fully control and own the experience of your customer during the creation of their payments account. Co-branding the onboarding increases trust and improves conversion rates.

2023: It's a wrap!

Dec 31, 2023

What did our Mollies achieve in 2023?

For the past 12 months our compass was set on one thing: What will help you grow?

So this year, our teams shipped more features, more products and more integrations than ever before! 🚀

Take a look at what we launched to drive revenue, increase payment conversion and support our merchants and partners in their growth.

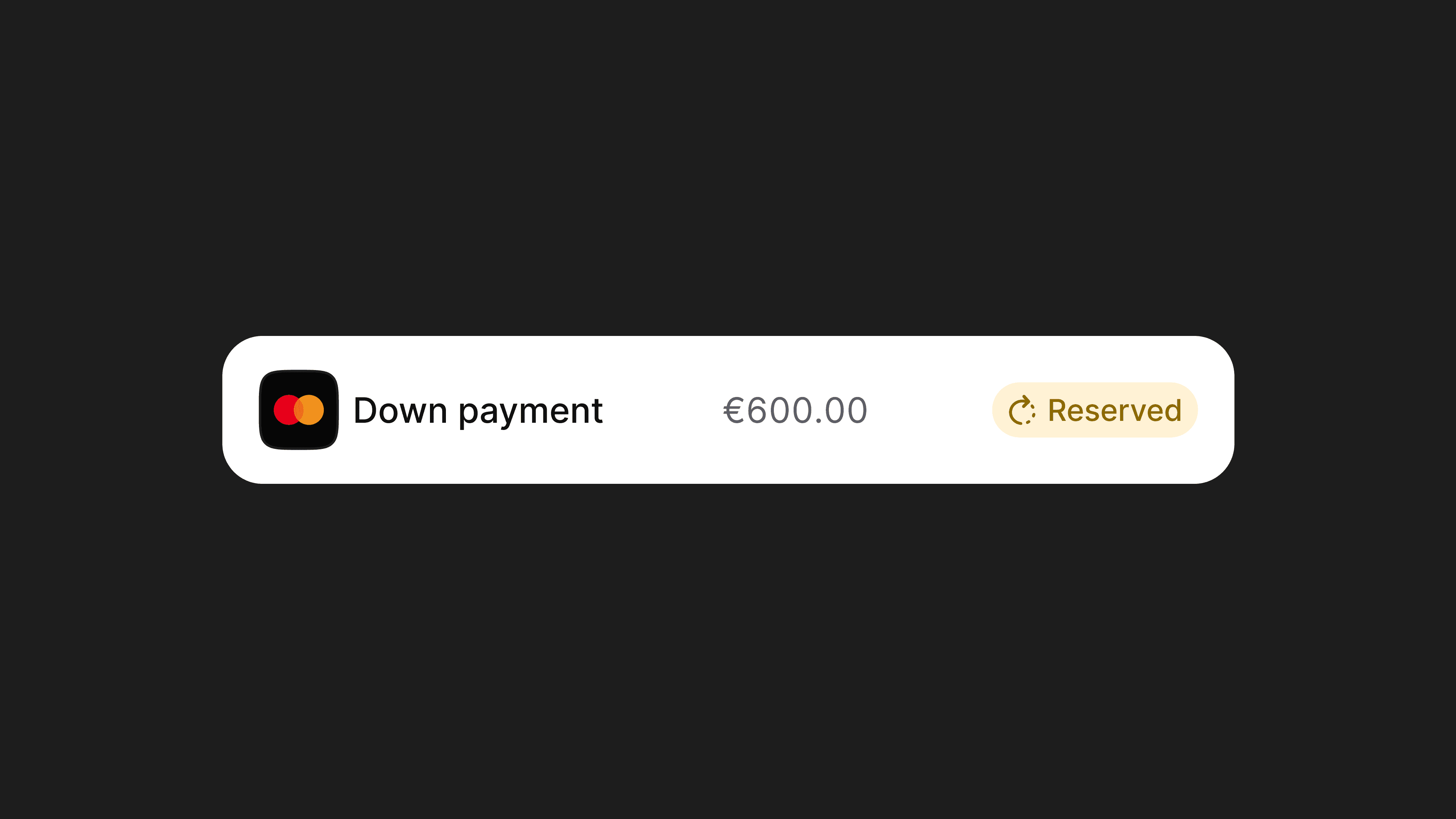

Place a hold for a card payment

It is now possible for you to reserve an amount on a card and capture the funds at a later time. Splitting of the authorization and the capture process will help you:

Improved customer experience: you will only charge the card when you are ready.

Reduced risk of chargebacks: if you are unable to fulfil the order or service, you can simply cancel the authorization.

This feature is already available in our Magento 2 integration, with more integrations following soon. Custom integrations can integrate this via our API.

Offer Klarna Financing in UK with Mollie

What is Klarna Financing?

Klarna Financing allows consumers to spread the cost of their purchase for up to 24 months. Whilst you still get paid up front.

Important to know: In order to be able to offer Klarna Financing your business must hold a UK Credit Broker License and be registered within the UK.

Merchant policies links

Dec 18, 2023

Mollie Checkout - Merchant policies links

We’ve added new features to help ‘personalise’ the Mollie Checkout 🔗

You can now add your T&Cs as well as Privacy policy links to the Mollie Checkout.

This small but mighty change helps with:

Reduce complexity to remain compliant with Cards and Payment industry standards

A known sign of trust for Shoppers

To add these settings, go to:

Organization Settings under Profile > Personalise checkout

👋 Say hello to MollieGPT, our revolutionary AI tool that helps you find the answer to your question in both our Help Center as our Dashboard.

Think of it like a Mollie Search Bar right at your fingertips, powered by 400+ Help Centre articles to offer precise, tailored responses. It’s specialised in answering all sorts of questions about Mollie and payments!

Why settle for traditional search methods when you can have an AI assistant? MollieGPT isn't just another tool; it's a smarter, more intuitive way to get the help you need.

Revenue widget for iOS

Nov 30, 2023

Introducing revenue widget on iOS

You can now add a revenue widget to the lock screen of your iOS device. The widget is available with Mollie app version 2.6.x and later.

We’ve also included a special Black Friday card in the Mollie App for you to easily track all incoming sales during the day.

Bancontact for recurring payments

Nov 29, 2023

Bancontact for recurring payments

We're thrilled to announce the launch of Bancontact WIP payments, taking your transaction experience to the next level.

💳 Improved customer experience: Expand your market reach and cater to the preferences of Belgian consumers who trust and frequently use Bancontact for their online transactions on a recurring basis

🔄 Seamless Integration: Bancontact WIP payments seamlessly integrate into your existing payment infrastructure with Mollie’s payment platform

B2B buy now, pay later with Billie just launched in new markets

With Billie, your business buyers get flexible payment terms and 30-day repayment options. And you get guaranteed payouts and full fraud and credit risk coverage.

Here’s how Billie has helped other B2B businesses:

🔄 Boosted conversion across the whole journey by 64%

📊 Increased average order values by more than 20%

🛒 Improved checkout conversion by 20%

Put simply: offering Billie can help you attract more customers, delight your existing customers, improve your cash flow, reduce costs, save you significant amounts of time, and drive revenue.

Ready to get started? Visit your dashboard and start accepting payments via Billie today.

Twint

Nov 15, 2023

🇨🇭 Ready to supercharge your business in Switzerland?

Unleash the power of TWINT for these incredible benefits:

💳 Seamless Mobile Payments: Your customers can make payments conveniently with just a tap on their smartphones.

📈 Boosted Sales: Experience an increase in sales as over 5m customers love the simplicity of TWINT.

🚀 Instant Transactions: Real-time payments provide faster cash flow for your business.

🛡️ Enhanced Security: TWINT offers robust security measures, protecting you from payment defaults and fraud.

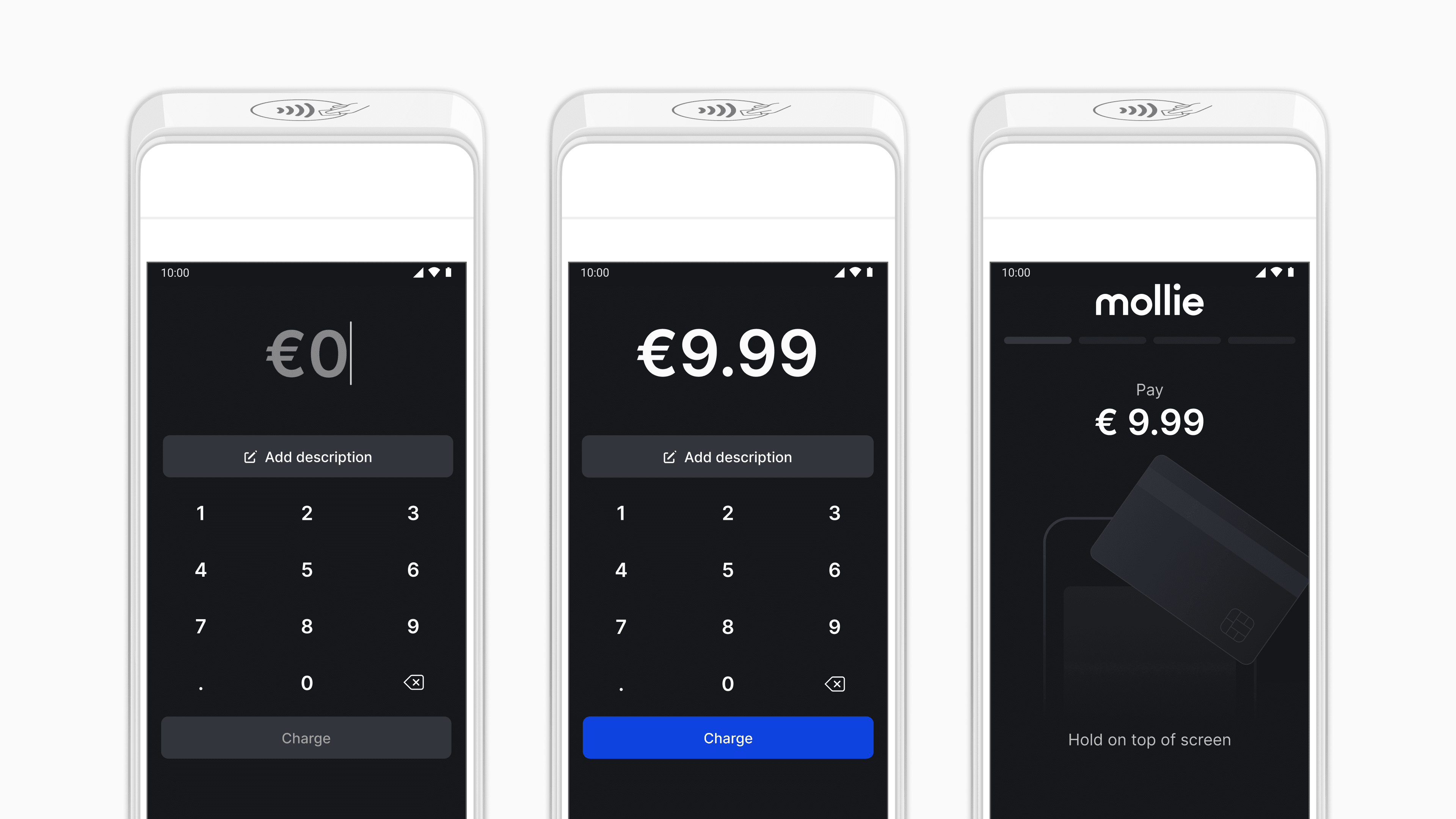

Terminal Initated Payments

Nov 8, 2023

🚀New Terminal Feature Alert: Introducing Terminal Initiated Payments! 🌟

What’s new? You can now enter payment amounts directly on our terminals, eliminating the need for API integrations or third-party solutions.

✔️Directly enter amounts for tips, splits, and custom payments

✔️Get paid without the need for a secondary device

✔️The simplest way to get up and running with Terminal

Mollie Dashboard redesign

Oct 15, 2023

The Mollie Dashboard has a new look

Get ready for the new Mollie Dashboard, coming your way in just a few days! We've given it a fresh, user-friendly redesign to elevate your Mollie experience.

Our new interface makes using our products and features easier than ever, while better harmonising the experience between the mobile and web version.

Rest assured, all our essential features remain intact: effortless payment management, detailed transaction insights, smooth reporting, and seamless reconciliation. Plus, our enhanced navigation is ready to host exciting new products in the near future. Stay tuned for what's next!

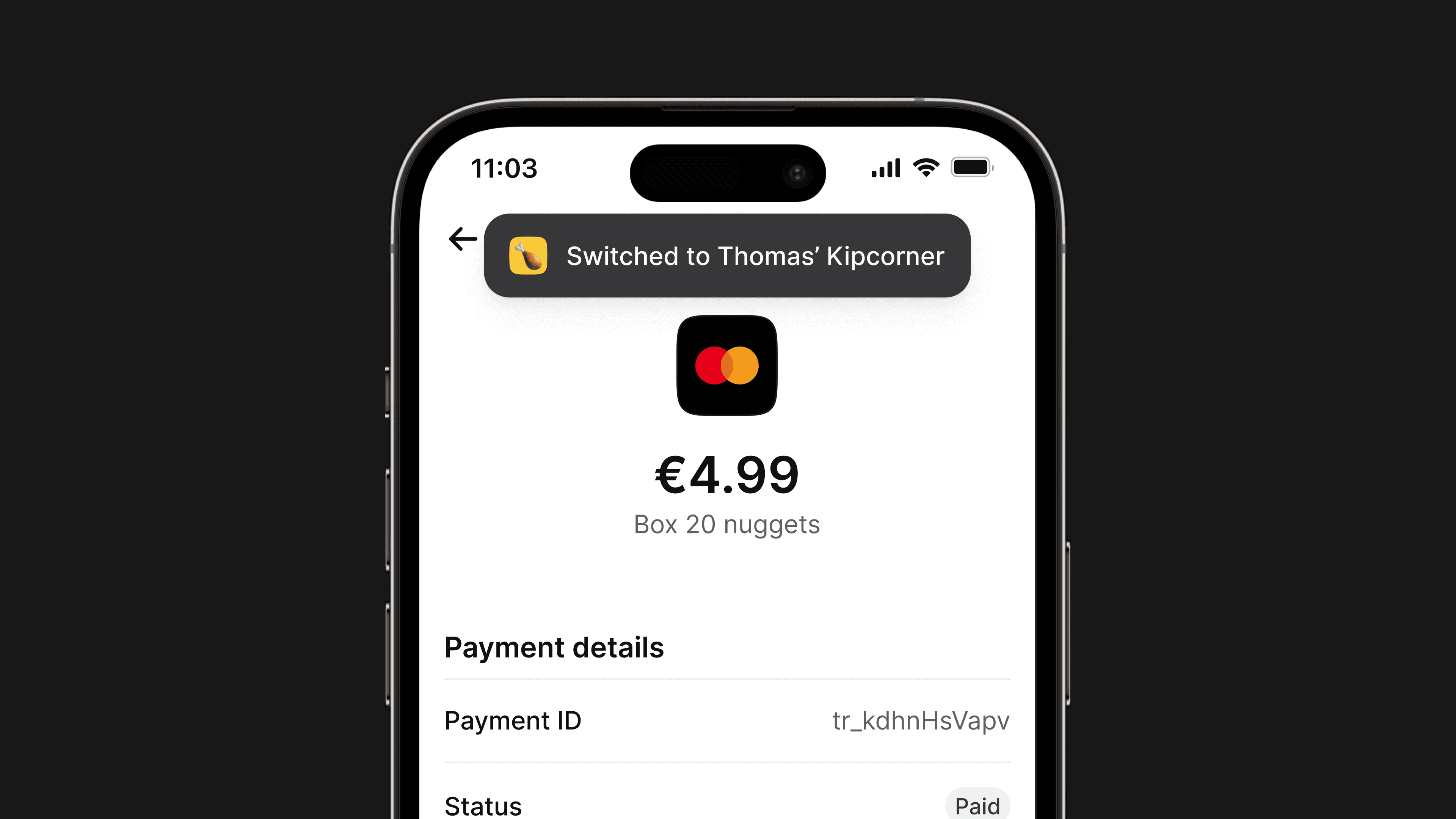

New Mollie App release

Oct 7, 2023

📱 New Mollie App release

In addition to resolving a few bugs, we've introduced some enhancements in this latest release:

🔄 Organisation switcher

For merchants who manage multiple organisations, it can be challenging to remember which organisation you're currently working with. To simplify this, you'll now receive a toast message when switching orgs, ensuring you're always in the right place.

🖨️ Copy IBAN

In response to a suggestion from one of our merchants, we've enabled the ability to copy and paste IBANs in the transaction detail page. Say goodbye to manual data entry – this one's for you, Patrick!

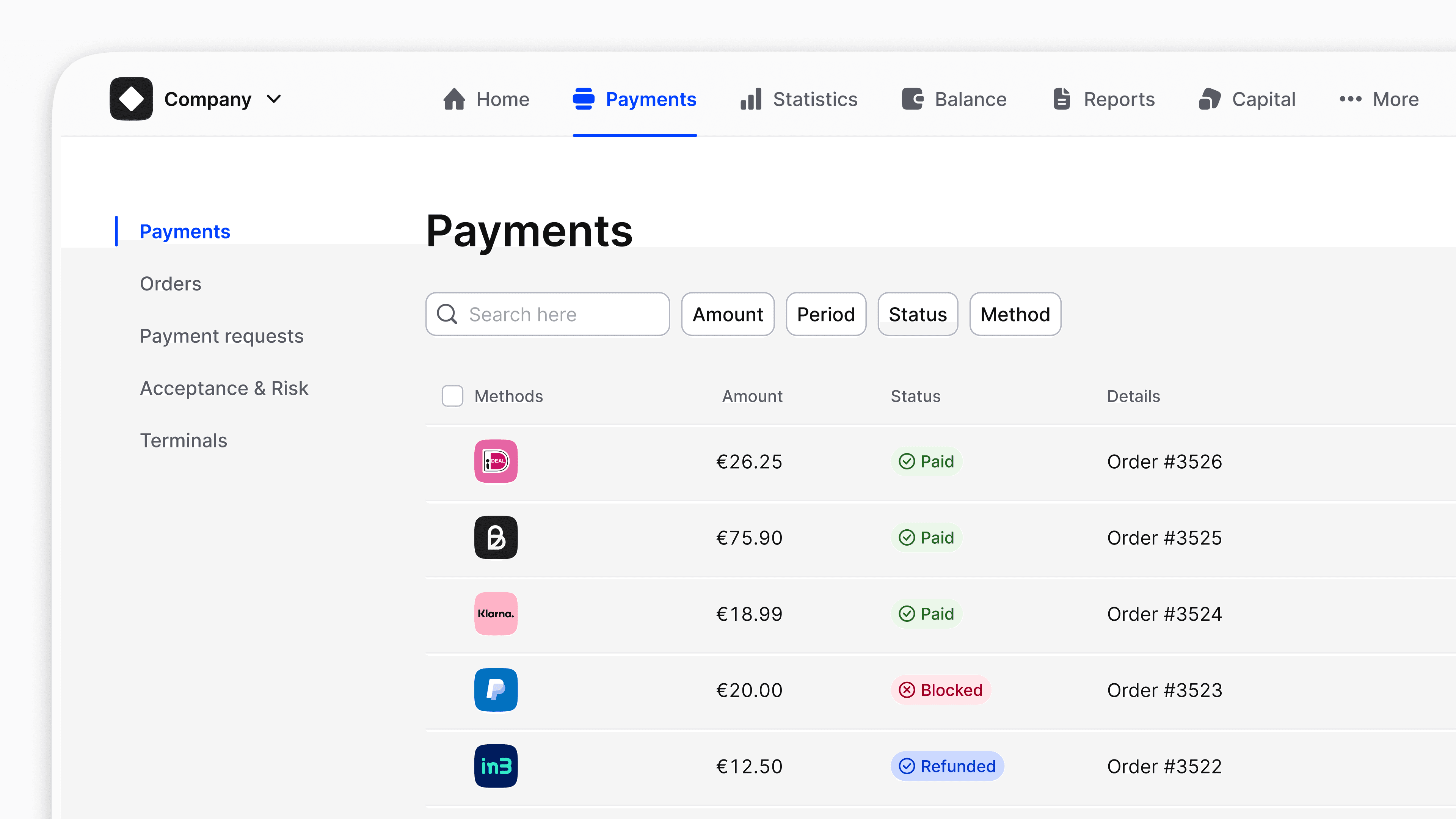

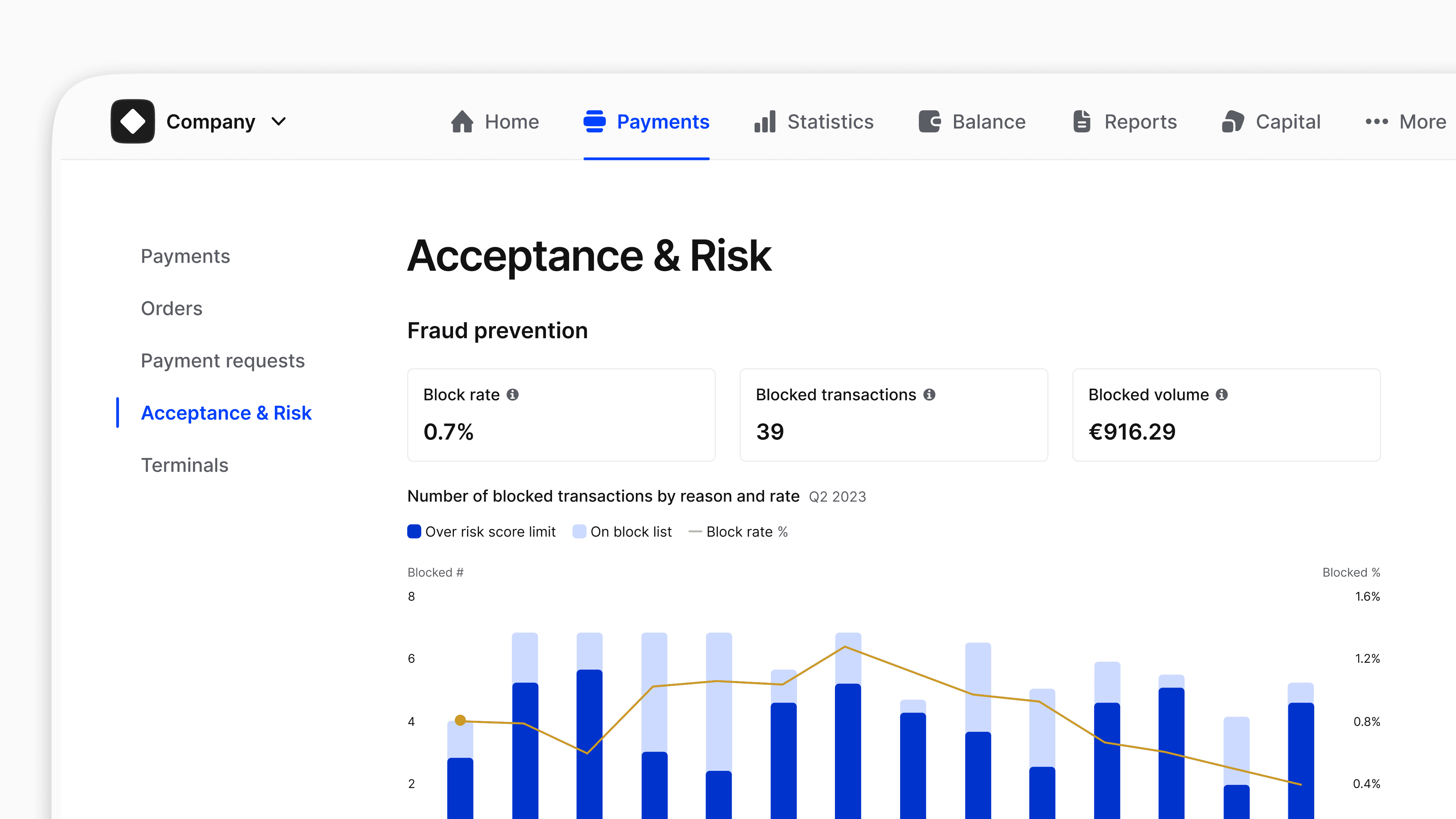

Acceptance & Risk

Sep 2, 2023

Acceptance & Risk - a way to optimise your card performance

Why have we built this?

We want every merchant to get the most from card payments, but we know they can be risky, expensive, and complex. Done well however, you will see big improvements in your checkout conversion.

What have we delivered?

Acceptance and Risk is a suite of tools and features that protect your business and boost your revenue with intelligent optimisation and customisable fraud prevention.

This includes features for all our customers:

Dynamic 3D Secure up to €100: Reducing checkout friction for your customers, ensuring a faster and more convenient payment experience

Intelligent Acceptance: Optimisations with card issuers and schemes, so they are more likely to accept payment requests

And premium features for businesses who want to maximise their benefits:

Dynamic 3D Secure up to €2000

Custom fraud protection, including block and trust lists, fraud risk assessments and personalised fraud screening rules

Insights and guidance, so you can optimise your business with advanced controls and expert support

Want to use this service?

Enable Acceptance & Risk today by contacting our Support team or your Customer Success Manager

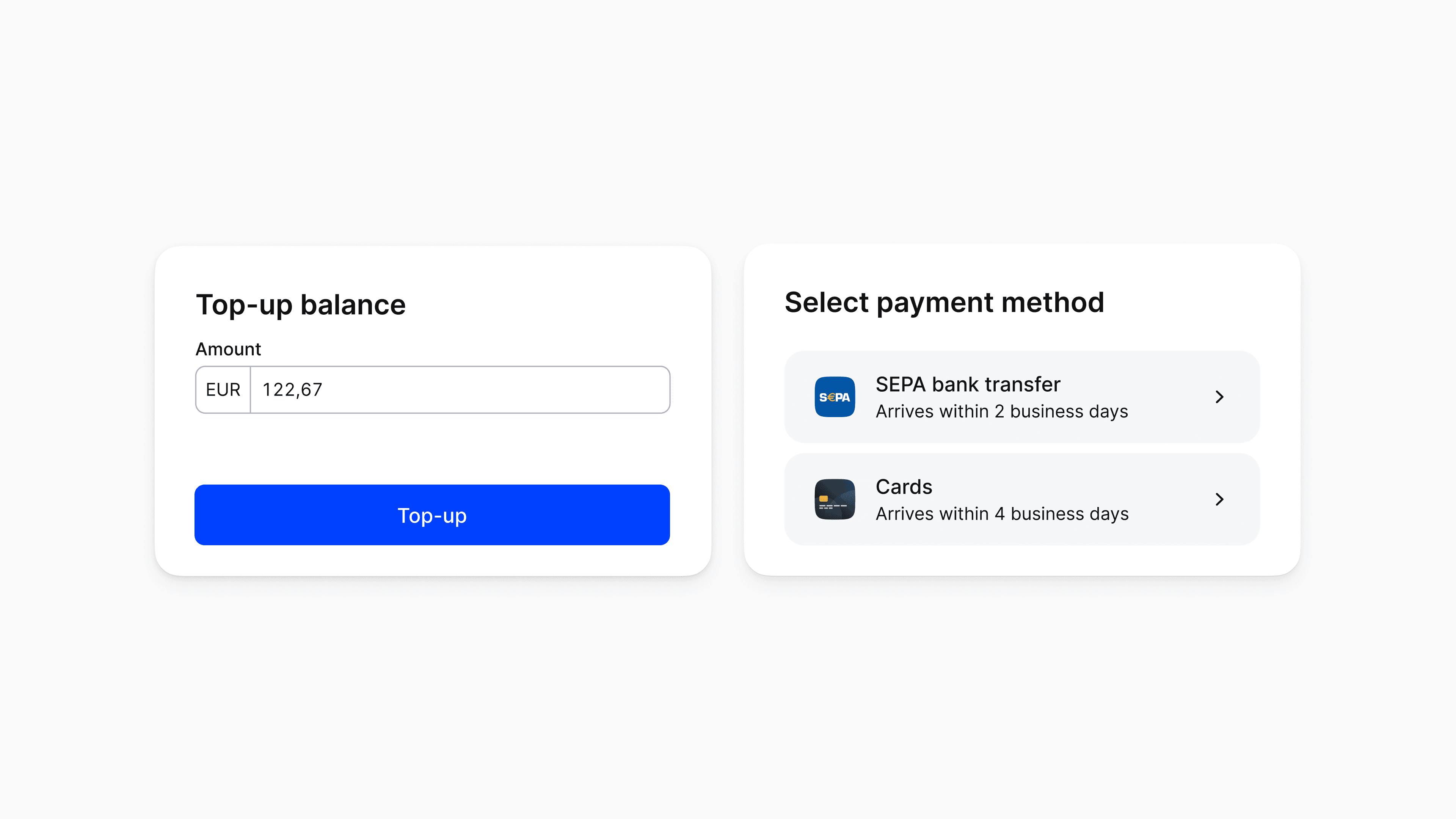

Improved balance top-ups

Aug 8, 2023

Improved balance top-ups

Your most requested enhancements to balance top-ups are here!

📈 Top-ups are no longer shown as revenue on your dashboard and related reports.

🥳 Top-ups can now be done via your local preferred payment methods. We have also eliminated transaction fees. Charges only apply when you use a credit or debit card.

🚄 Settlement delays for top-ups have been considerably reduced.

💸 You now have the flexibility to increase your top-up amount to accommodate incoming refunds more effectively.

⚖️ Top-ups are not limited to handling queued refunds; you can also use them to offset negative balances.

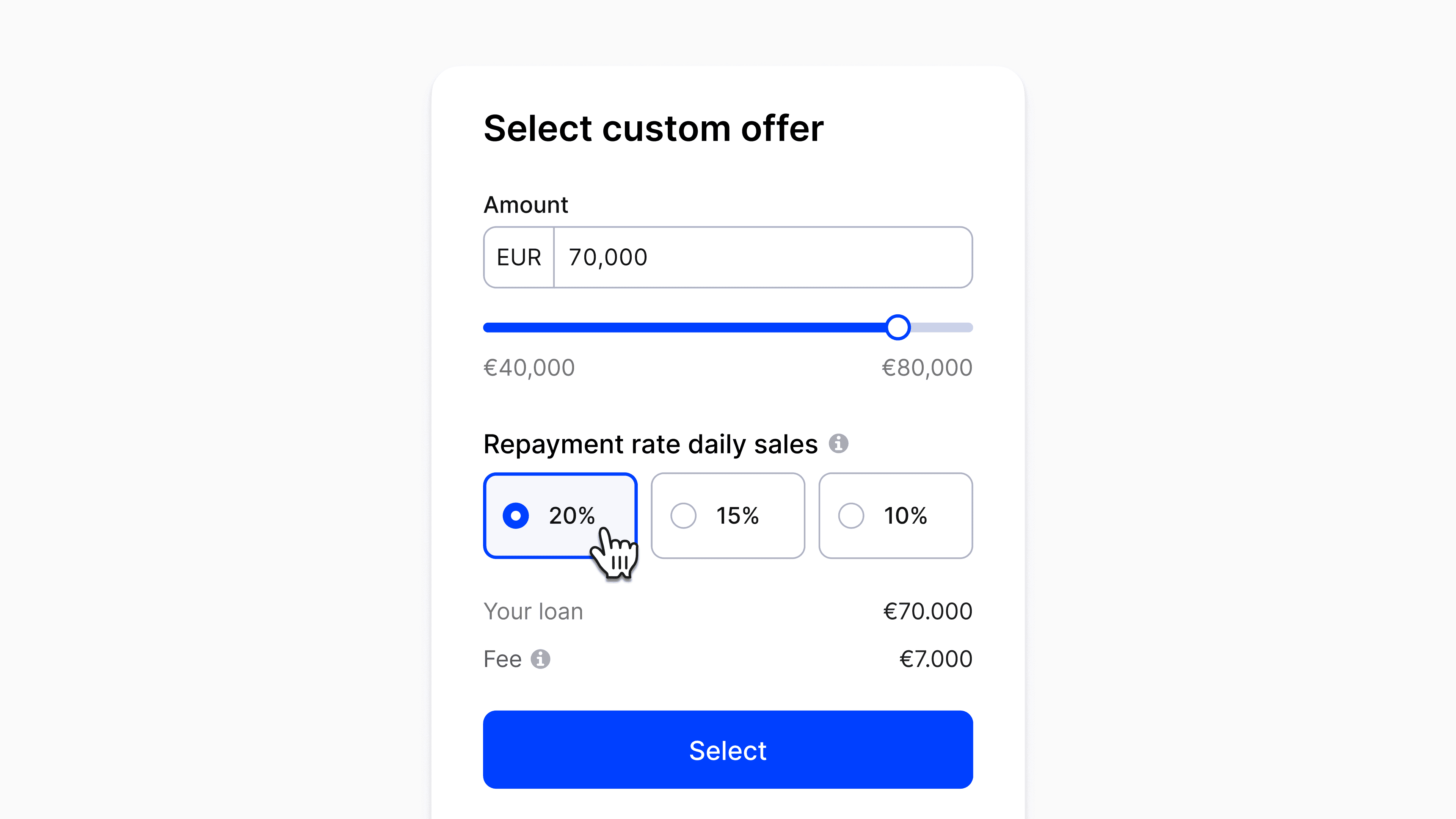

Custom offers for Mollie Capital

Jul 20, 2023

🎛️ Custom offers available for Mollie Capital

It's now possible to customise the terms of Capital offers. When you apply for a Mollie Capital loan, you'll not only receive three tailored offers but also have the flexibility to select the exact loan amount and repayment rate that align with your business needs.

Mollie App 2.0

Jul 12, 2023

📱 Mollie App version 2.0 is live

✨ The Mollie App has a new facelift, enhancing its usability and facilitating your access to frequently used functions. This transformation sets the stage for the exciting additions that we'll soon be introducing!

💡 With this we also added a shiny new feature: The light mode. You can now switch between dark and light vibes.

Mollie strengthens B2B product offering through Buy Now, Pay Later partnership with Billie.

🌟 What does this mean for your business? Now, your business customers can enjoy the convenience of purchasing goods and services and deferring payment for up to 30 days. The best part? You will receive your payment immediately. This is a game-changer for optimizing cash flow management.

Here are some key benefits of our BNPL solution:

💳 Real-time Approval: Your customers can enjoy seamless, real-time loan approval at checkout, making their buying experience smoother than ever.

🛒 Generous Shopping Cart Limits: With shopping cart limits of up to €25,000, your customers have the flexibility to make substantial purchases without hassle.

🚫 Comprehensive Protection: Full protection against non-payment and fraud risks, safeguarding your business interests.

Enhancing Payment Links features

Apr 1, 2023

Enhancing Payment links features

At Mollie, we're committed to making each product more seamless and user-friendly. Today we would like to introduce two features:

1️⃣ QR Code Generation: Say goodbye to the hassle of generating QR codes separately! You can effortlessly create a QR code for any payment link directly from your Mollie dashboard.

2️⃣ Payment History Access: Keeping track of your payment history just got easier! With our latest update, you can conveniently view the payment history for a specific payment link right within the Mollie Dashboard. Stay organized and in control of your transactions.

These enhancements are designed to empower you and streamline your payment processes. We're always striving to provide you with the best tools to succeed in your business.