Buy Now Pay Later

Increase conversion rates, order values, and customer loyalty by offering your customers a range of flexible ways to pay – all through Klarna. Combine all Klarna options into one seamless method and let your customers pick the payment type and terms they prefer.

Start accepting today

Only pay per transaction

Cancel anytime

Win new customers

Attract new customers who want to use Klarna’s flexible payment methods.

Build loyalty and drive repeat purchases

Help customers choose payment terms that suit them to drive trust and build loyalty.

Increase conversion

Boost conversions and increase your average order value with a range of payment options.

Increase conversion rates, order values, and customer loyalty by offering your customers a range of flexible ways to pay – all through Klarna. Integrate Klarna in your ecommerce store to offer a range of payment options so your customers pick the payment type and terms they prefer.

Frequently asked questions

Why Klarna?

Offer a range of payment options designed to make online sales smooth and easy and attract over 150 million active consumers who already trust Klarna payments. Join more than 500,000 retailers that offer seamless payment solutions with Klarna.

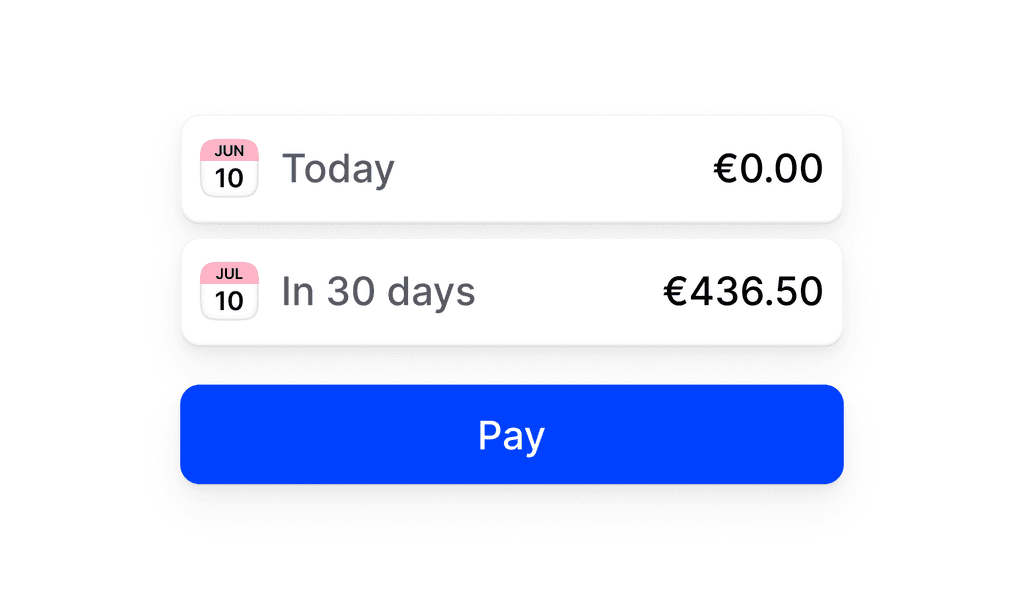

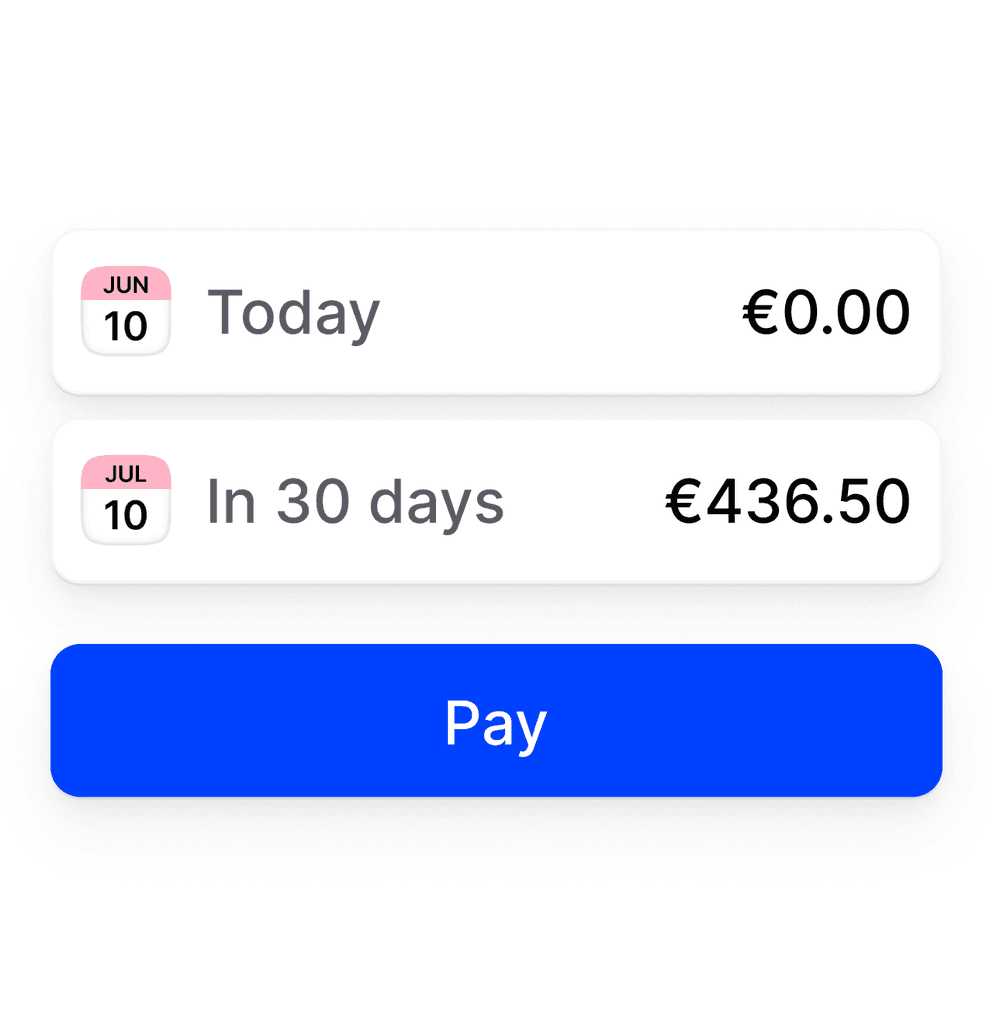

What is Klarna Pay Later?

How does it work?

With Klarna Pay Later, customers can complete a purchase and defer their payment for a set period. They then receive their product before any money leaves their bank account. Klarna sends an email with payment instructions after shipping, allowing a set period of 30 days to pay for their goods.

Why offer it?

Klarna Pay Later is perfect for customers who prefer receiving items before paying, want to test a product before buying, or want to defer a payment to manage their cash flow. It offers flexibility and convenience.

What is Klarna Pay Now?

How does it work?

Klarna Pay Now lets customers pay in full at the time of purchase using a stored card or their banking details. This speeds up the checkout process and boosts conversion. The customer uses their preferred payment methods (such as a credit card, debit card, or bank transfer) to quickly pay.

Why offer it?

Ideal for customers who prefer paying upfront and completing transactions without delay. It's a straightforward option for those who love to pay with Klarna but are not eligible for Pay in 3 or Pay Later.

What is Klarna Pay in 3?

How does it work?

Klarna Pay in 3 divides purchases into three equal payments that Klarna automatically collects every 30 days. The customer pays the first instalment when they buy their item, and pays the remaining two instalments over a set time period. The transaction amount must be at least €35 and less than €3,000.

Why offer it?

Designed for customers who prefer to defer payments over a longer period of time (and avoid paying interest). It offers flexibility and budgeting assistance by breaking larger payments into smaller, manageable instalments.

What is Klarna Financing?

How does it work?

Klarna Financing spreads transaction costs over a set period –up to 36 months. This allows your customers to finance purchases over time.

Why offer it?

Suitable for larger purchases that customers want to gradually pay for their purchases over a longer period of time, it offers set monthly payments for effective budget management. However, consumers that use Klarna Financing do pay interest.

Good to know

To activate Klarna Financing, a UK Credit Broker License is needed, registered with the UK government. Submit your Credit Broker License, org ID, and request to enable Klarna Financing via our contact form. No specific regulation applies to businesses outside the UK.

€69.99

Sneaker laces

Sneaker laces

23/09/2022 17:29

€69.99

Paid

Consumer name

T. Otter

Are you already a Mollie customer?

Simply activate the new payment method in your Dashboard.